MiFinity Expands Global Reach

MiFinity continues to expand its global reach, offering enhanced payment solutions across new regions.

- Supports 17 currencies

- Available in 225 countries

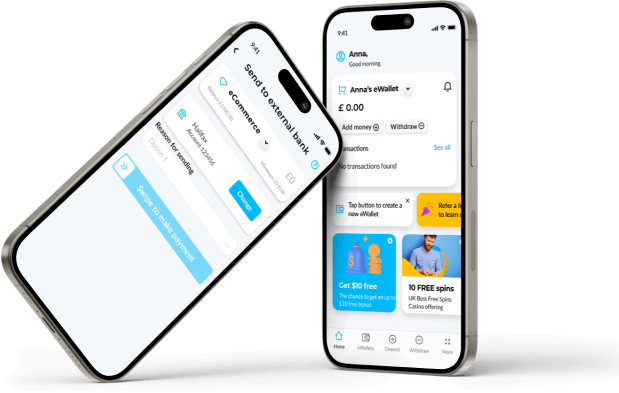

- Innovative eWallet services

- Seamless payment integrations

Discover how MiFinity has become a significant player in the global digital payments landscape, offering tailored solutions across industries.

MiFinity is a globally recognized eWallet and payment solution platform that has revolutionized how individuals and businesses conduct online transactions worldwide. As the fastest-growing payment service provider in the iGaming industry, MiFinity serves as a critical infrastructure for cross-border money transfers, online payments, and financial transactions across multiple sectors, including gaming, travel, forex, eCommerce, and remittance services. The platform's importance in the modern digital economy stems from its ability to simplify international payments while maintaining security and compliance across diverse regulatory environments.

MiFinity was established in 2002 and has evolved into a comprehensive payments provider with over 25 years of online payments experience. The company achieved a significant milestone in 2018 when it launched the MiFinity eWallet, which marked the beginning of its remarkable growth trajectory in the digital payments space. Operating from Belfast, Northern Ireland, MiFinity was incorporated on February 14, 2012, as Mifinity UK Limited and has since expanded into a medium-sized fintech enterprise. Under the leadership of CEO Paul Kavanagh, the company has strategically positioned itself as a global payments provider serving merchants and customers across multiple industries.

MiFinity offers an impressive array of features designed to facilitate seamless international transactions:

MiFinity has revolutionized the payment solutions industry by offering multi-currency wallets and extensive local payment integrations.

The platform's reach extends to 225 countries, providing comprehensive payment solutions across multiple sectors.

MiFinity operates as a dual-licensed organization, providing it with a robust regulatory framework and global credibility. The company holds licenses from:

These dual licenses provide MiFinity's operations with a global footprint and ensure compliance with stringent international financial regulations. The platform employs a highly secure infrastructure with best-in-class security protocols to protect customer data and transaction integrity. The company's commitment to security extends to partnerships with major payment providers, including integration with Apple Pay, which provides additional authentication features such as Face ID and fingerprint recognition.

While specific details about the sign-up process are not extensively detailed in available information, MiFinity's user registration involves creating an eWallet account that enables users to perform transactions with multiple local payment options in different currencies. The platform currently serves more than 650,000 users worldwide across over 650 merchant websites.

MiFinity facilitates both domestic and international money transfers through its eWallet platform. Users can:

The platform's architecture enables fast, simple, and secure transactions, with the ability to leverage local payment methods for deposits and withdrawals.

MiFinity serves diverse customer segments and use cases:

MiFinity distinguishes itself through competitive pricing on foreign exchange fees and transaction costs. The platform's integration with 75+ local payment methods enables users to minimize currency conversion costs by maintaining multiple currency wallets. Additionally, MiFinity's affiliate program, launched in 2022, demonstrates the company's commitment to value—offering commissions up to 35% with lifetime commissions paid on all deposits and FX fees. This structure indicates that the underlying business model supports cost-efficient operations.

MiFinity prioritizes user experience through several design principles. The platform offers a multilingual interface in 21 languages, ensuring accessibility for global users. The eWallet is designed as a fast, simple, and secure solution for online transactions, and the company has invested in UI/UX design expertise to maintain interface quality and intuitiveness. Integration with modern payment technologies like Apple Pay demonstrates MiFinity's commitment to providing contemporary, secure payment methods that users actively want to use.

MiFinity's availability in 225 countries and territories with support for 17 currencies positions it as one of the most accessible eWallet solutions globally. The platform's rapid growth—expanding from launch in 2018 to serving 650,000+ users and 650+ merchant websites—reflects strong market acceptance and accessibility. The company's strategic focus on assisting businesses entering new markets, particularly in regions like Asia, demonstrates its commitment to expanding accessibility and supporting merchants in scaling their operations across different geographic regions.

While MiFinity has established itself as a reliable payment provider, users may encounter challenges related to account verification processes. The platform's compliance with regulations in 225 countries and dual licensing requirements necessitates thorough verification procedures, which some users may find cumbersome or time-consuming. Specific withdrawal issues and verification challenges are not detailed in the available information, but such processes are common across highly regulated fintech platforms.

The quality and responsiveness of customer support represent an important consideration for users. While MiFinity maintains a professional infrastructure with dedicated teams including Client Services Advisors, specific user feedback regarding support responsiveness is not extensively documented in the search results. Users seeking detailed information about support channels and response times may need to contact the company directly.

Operating across 225 countries requires MiFinity to navigate complex and sometimes conflicting regulatory requirements. Certain jurisdictions may impose restrictions on specific services or payment methods, potentially limiting functionality for users in particular regions. The platform's compliance obligations may also result in restrictions on certain transaction types or user categories.

MiFinity has established itself as a significant player in the global digital payments landscape, offering a comprehensive eWallet solution that addresses the needs of diverse users across multiple industries and geographic regions. The platform's strengths lie in its extensive regulatory compliance through dual licensing, global accessibility across 225 countries in 21 languages, support for 17 currencies with up to nine multi-currency wallets per user, and integration with over 75 local payment methods.

The company's proven track record—growing from 2018 launch to serving 650,000+ users on 650+ merchant websites—demonstrates strong market acceptance. MiFinity's strategic investments in security infrastructure, modern payment integrations like Apple Pay, and expansion into emerging markets like Asia further reinforce its position as a reliable payment provider.

However, prospective users should be aware of potential challenges including the verification processes required by regulatory compliance, variable customer support responsiveness, and possible regional restrictions based on jurisdiction-specific regulations. Despite these considerations, MiFinity remains a viable and competitive solution for individuals and businesses seeking secure, efficient, and globally accessible payment services in an increasingly interconnected digital economy.

We collaborate with top industry leaders to bring you reliable and innovative payment solutions.

MiFinity continues to expand its global reach, offering enhanced payment solutions across new regions.

Discover MiFinity's latest advancements in payment security and compliance.

MiFinity has announced new strategic partnerships to enhance its service offerings across emerging markets.

MiFinity now supports additional currencies, broadening its appeal to international users.

MiFinity has been awarded 'Best Payment Solution' for its unparalleled service and innovation.